Summary

- Murphy Oil shows a significant upside potential with new wells in the Gulf of Mexico and offshore Vietnam coming into production.

- Despite revenue consolidation in 2023 due to oil and gas price decreases, Murphy Oil remains resilient with a focus on offshore production growth and exploration activities.

- The company has successfully reduced debt and aims to further reduce debt, and improve shareholder returns through share buybacks and potential dividend increase.

- Operational excellence and strong liquidity position, coupled with ongoing debt reduction efforts, bolster Murphy Oil’s profitability outlook.

Investment Thesis

Murphy Oil Corporation (NYSE:MUR), in my view, is a company with significant upside potential going forward. The long-term outlook seems good for the company with new wells in the Gulf of Mexico and Vietnam coming into production, and robust demand for oil persisting, as many countries in the world are slowing down and rethinking their net-zero goals while developing a more realistic approach to cutting fossil fuel use.

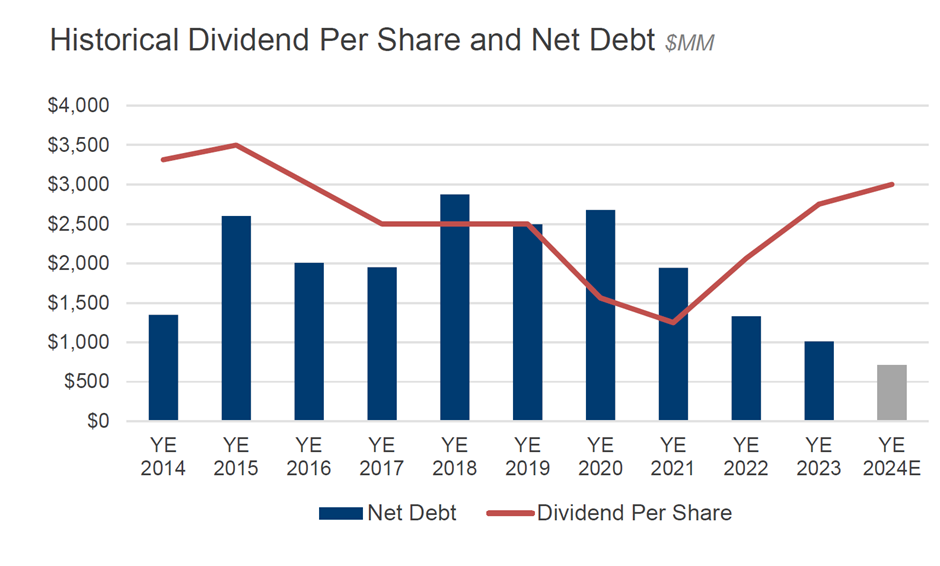

Additionally, the company was able to achieve the ambitious goal of $500 million debt reduction in the year 2023, reducing debt to $1.3 billion under Murphy 2.0 of the capital allocation framework, which it began in 2023 with a total debt level of 1.8 billion, allocating 25% of adjusted free cash flow to shareholders and 75% to further debt reduction. Now, the company aims to reduce debt by $300 million in the year 2024 and reach Murphy 3.0 by year-end, directing a change in capital allocation with 50% allocated to shareholders and 50% to the balance sheet, resulting in increased shareholder returns through share buybacks and potential dividend increase. Therefore, I have a buy rating on this stock.

About Murphy Oil

Based on its 10K report, “Murphy Oil Corporation is a global oil and gas exploration and production company with both onshore and offshore operations and properties… The Company produces crude oil, natural gas, and natural gas liquids primarily in the U.S. and Canada and explores for crude oil, natural gas, and natural gas liquids in targeted areas worldwide… Murphy’s worldwide 2023 production on a barrel of oil equivalent basis was 192,640 barrels of oil equivalent per day.“

Revenue Analysis And Outlook

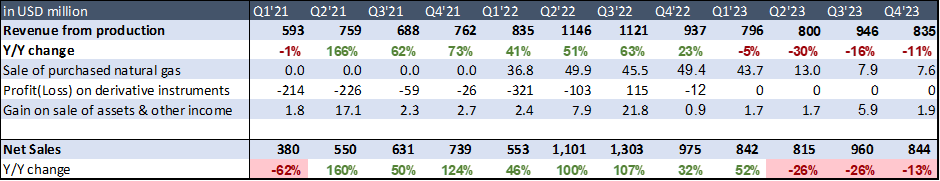

After strong growth in 2022, due to geopolitical uncertainty, market disruption from the Russia/Ukraine conflict, and lack of investment in the exploration and production sector, Murphy’s revenue growth in 2023 started consolidating due to a decrease in the price of oil and natural gas. West Texas Intermediate (WTI) crude oil prices averaged $77 per barrel in 2023 compared to $94 per barrel in 2022, due to which its reported revenues of $844.2 million in the fourth quarter of 2023 and missed consensus estimates. Revenues decreased by 13.4% from the prior-year quarter of $975.2 million. For the full year 2023, total revenues were $3.46 billion, down 12% year over year, primarily due to a decrease in the average price compared to the previous year.

The company produced 186K barrels of oil equivalent per day for the year, comprising over 52% of oil volumes with a realization of over $77 per barrel for oil. The total reserve replacement ratio for the year 2023 was 139% with 724 million barrels of oil equivalent in preliminary proved reserves. This increase was due to an additional 13 million barrels equivalent of proved reserves for the Lac Da Vang field in Vietnam as well as AECO (Canadian benchmark for natural gas price) price changes.

Two fields in the Gulf of Mexico which had issues during 2023 are anticipated to resume production by mid-2024. Additionally, the issue with subsea equipment in the Mormont field is expected to be repaired in the first quarter of 2024, and the non-operated Lucius well is now forecasted to return to production shortly, implying a positive near-term growth outlook for the company.

During the fourth quarter, production resumed at the non-operated Terra Nova field in offshore Canada with plans to ramp up production through the first quarter of 2024, and it also began procuring equipment for the Lac Da Vang field development in Vietnam, which was sanctioned by the board in the fourth quarter. In addition to the LDV field, two other exploration wells planned in 2024 in Vietnam with one well nearing the platform facility, provide upside potential to the company.

In the Gulf of Mexico, the company also acquired an 8% working interest in the Zephyrus discovery for $13 million, and it was named the apparent high bidder in 8 exploration blocks in the Gulf of Mexico Federal Lease Sale 261. Furthermore, with planned average annual Capex of over $1 billion annually through 2026, the management expects it should be able to grow the company at a 5% CAGR and increase production up to an average of 195,000 barrels of oil equivalents per day with significantly higher offshore production.

Moving forward, the main focus of the company is expected to achieve first oil in offshore Vietnam and planned key explorations in the Gulf of Mexico, Vietnam, and Côte d’Ivoire. All these E&P activities give positive momentum for the company in the long term.

Profitability Analysis And Outlook

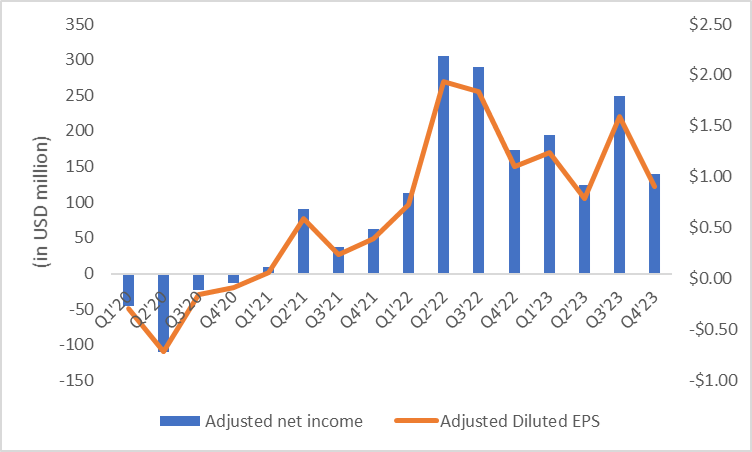

Due to another strong operational quarter, adjusted EBITDA for the quarter was $414 million, and the EBITDA margin was 49%, increasing 100 basis points year-over-year. Adjusted net income for the period was $140 million, and the adjusted net income margin was 17%, decreased 100 basis points Y/Y. This decrease in net margin was due to an unfavorable volume mix and decreased average price of crude. As a result, in the fourth quarter of 2023, adjusted diluted EPS was only $0.90, missing the consensus estimates by $0.09.

Its production for the year comprised only 52% of oil volumes and 58% of liquid volume, decreased significantly compared to last year’s figure of approximately 54% and 62% respectively, which has negatively impacted the profitability of the company as these are high margin products compared to natural gas. However, I expect it should improve in fiscal 2024 as these are fluctuations which companies have long experience in dealing with, and also new wells coming into production will add more liquid to its portfolio. The negative impact should also be offset by lower interest expense due to decreased debt and operational excellence as showcased by the company’s recent EBITDA performance, and further fueled by solid demand for fossils, which is not fading anytime soon.

Balance sheet Analysis

Murphy Oil ended the fourth quarter of 2023 with $317 million of cash, long-term debt of over $1.3 billion, due to the reduction in total debt by $500 million in 2023 alone and over $1.7 billion since year-end 2020. The reduction in net debt was due to the high average price of crude in the recent years. The company is expected to further decrease its debt by around $300 million in fiscal 2024, which should ultimately improve the company’s margins as well as the balance sheet.

Murphy has done a tremendous job in reducing debt; it retired $250 million of senior notes due in 2027, 2028, and 2029 through a tender offer during the last quarter of 2023. Now it has $1.3 billion of senior notes outstanding and $1.1 billion of liquidity. I believe with a strong liquidity position and deleveraging balance sheet, the company should be able to continue its average accrued CapEx of $1 billion as well as increasing the return for shareholders through higher dividends and share buybacks.

Risk

The company experienced mechanical issues at two operated Gulf of Mexico fields in 2023, i.e., the Dalmatian well and Neidermeyer well, both anticipated to resume production by mid-2024. Additionally, the company experienced an issue with subsea equipment in the Mormont field, where the repair is expected in the first quarter of 2024. This is because the company is prone to harsh climate conditions in the offshore fields resulting in production halt and repair at any time, and it is not uncommon for E&P companies with high offshore presence to have high risk as well as significant upside returns associated.

The company is also associated with risk due to price fluctuation in the oil and natural gas market even though the company actively tries to hedge it through derivative contracts.

Valuation

In my Dividend Discount Model (DDM) calculation, I am using FY24 annual dividend payout of $1.20, required rate of return of 12%, and a dividend growth rate of 10%, based on the recent years uptrend in dividend payments by the company and payout ratio of only 24.34%. I expect the company is slowly moving to its high dividend yield era of pre-2016, so my 9% dividend growth rate is on the conservative side. With my calculation, I arrived at a fair value of $60 for MUR stock. This is a discount of around ~27.33% at the current price level of $43.65.

Using relative valuation, the stock is currently trading at 10.46x FY24 consensus EPS estimate of $4.17, which is again a deep discount compared to its historical 5-year average P/E (FWD) of ~15x.

Conclusion

As discussed above, the company is currently trading below its fair value. The company is fueled for strong growth, due to new wells expected to come into production, and the company further deleveraging of its balance sheet. Also, its forward dividend yield is currently 3.15%, has improved significantly in the recent quarters and is slowly moving towards the pre-2016 times when it used to average around ~5%. This increase is due to higher capital allocation for shareholder returns under Murphy 3.0 framework compared to Murphy 2.0. It makes the stock a compelling choice for someone looking for a high dividend growth E&P company. Due to these positive factors, I have a buy rating on the stock.

Subscribe to receive future updates before anyone else.

Disclosure

This article contains author(s) opinions. The author of this report is not a licensed broker, research analyst or investment advisor. Therefore, It should not be taken as investment advice or recommendation.

The author of this report, or a member of their household, does not hold a financial interest in the securities of this company, and is not aware of any conflicts of interest that might bias the content of this report.